Last week the Federal Reserve Board's Sarah Bloom Raskin

addressed the National Community Reinvestment Coalition

about employment options for moderate and low income working

Americans. Her talk was a reflection on the Federal Reserve's

decision to lower short-term interest rates, and the effect of the

stimulus on the economy and unemployment:

The Federal Reserve's primary monetary policy tool is its

ability to influence the level of interest rates. Federal Reserve

policymakers pushed short-term interest rates down nearly to zero

as the financial crisis spread and the recession worsened in 2007

and 2008. By late 2008, it was clear that still more policy

stimulus was necessary to turn the recession around. The Federal

Reserve could not push short-term interest rates down further, but

it could--and did--use the unconventional policy tools to bring

longer-term interest rates such as mortgage rates down further.

And yet, concedes Raskin, "while the Federal Reserve's monetary

policy tools can be effective in promoting stronger economic

recovery and job gains, they have little effect on the types of

jobs that are created, particularly over the longer term." Speaking

of types of jobs, Mark Spitznagel, a hedge fund founder and

contributor to The Wall Street Journal, argued

last year that the Fed's role in the recovery was to make the

rich richer:

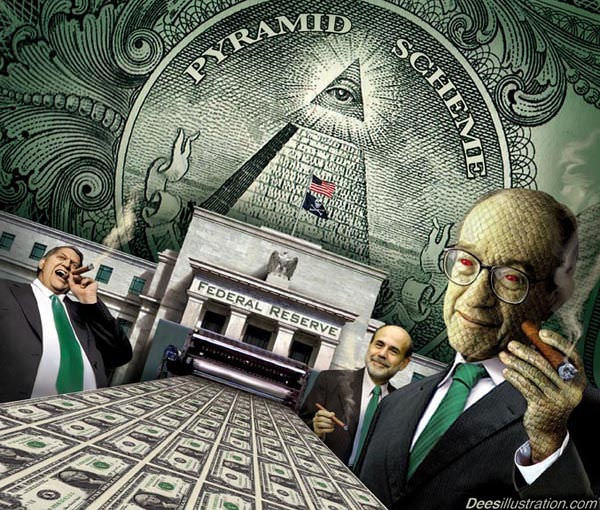

The Fed doesn't expand the money supply by uniformly dropping

cash from helicopters over the hapless masses. Rather, it directs

capital transfers to the largest banks....The Fed is transferring immense wealth from the middle class to

the most affluent, from the least privileged to the most

privileged. This coercive redistribution has been a far more

egregious source of disparity than the president's presumption of

tax unfairness (if there is anything unfair about approximately

half of a population paying zero income taxes) or deregulation.

While the Fed can alter short-term interest rates, print money,

and go on an indefinite bond-buying spree, all that does is

increase stock prices for the already wealthy.

Such actions leave moderate and low incomes unchanged while

decreasing the purchasing power of their income.

0 σχόλια:

Δημοσίευση σχολίου